Life is unpredictable. Job losses, medical emergencies, car repairs, and unexpected home maintenance can strike at any time. Without proper financial preparation, these surprises can lead to debt, stress, and long-term financial setbacks. An emergency fund serves as your financial safety net, providing peace of mind and financial stability when life throws its inevitable curveballs. This guide will explain why an emergency fund is essential and provide practical steps to build one that works for your situation.

Why You Need an Emergency Fund

An emergency fund is a dedicated amount of money set aside for unexpected expenses or financial emergencies. Here's why it's a critical component of your financial health:

1. Prevents Debt Accumulation

Without emergency savings, unexpected expenses often end up on credit cards or as personal loans, potentially creating a cycle of high-interest debt that can take years to escape. An emergency fund allows you to handle these costs without borrowing.

2. Provides Peace of Mind

Knowing you have money set aside specifically for emergencies reduces financial stress and anxiety. This psychological benefit shouldn't be underestimated—financial peace of mind contributes significantly to overall well-being.

3. Creates Financial Stability

An emergency fund acts as a buffer between you and life's financial surprises, maintaining your financial stability even when facing temporary setbacks. This stability allows you to stay on track with your other financial goals.

4. Offers Freedom and Flexibility

With emergency savings in place, you have more options when facing major life decisions. Whether it's considering a career change, relocating for better opportunities, or taking time off to care for a family member, having financial padding gives you more freedom to make choices.

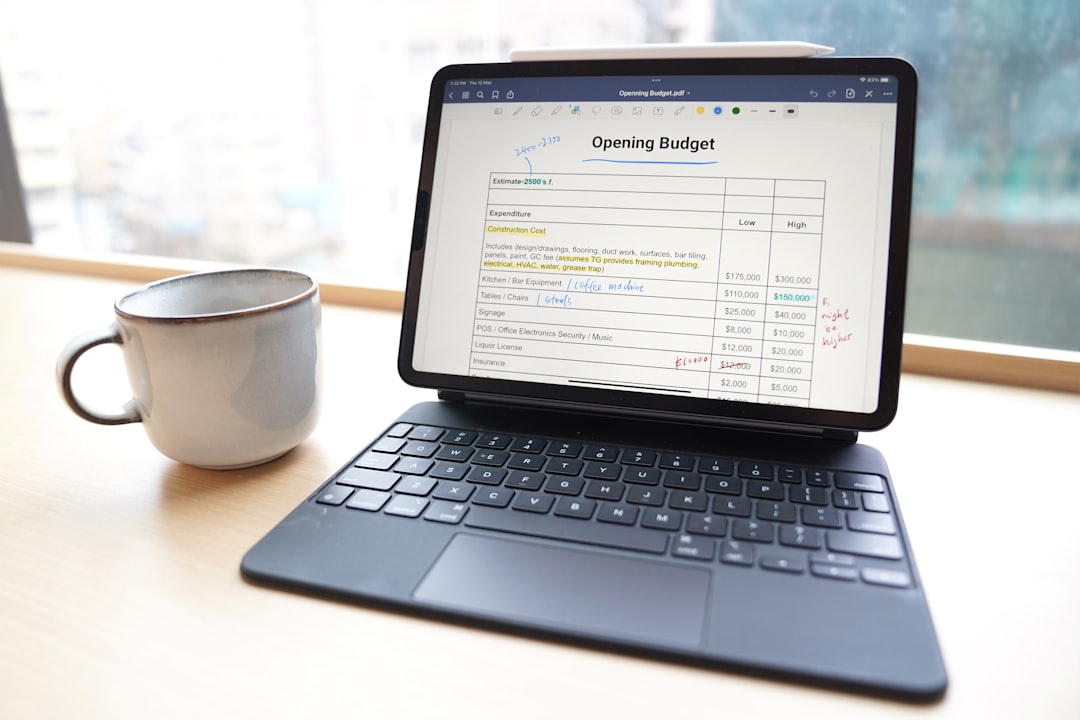

An emergency fund provides both financial security and peace of mind during uncertain times.

How Much Should You Save?

Financial experts typically recommend having 3-6 months of essential expenses saved in your emergency fund. However, the "right" amount varies based on your personal circumstances:

Factors That Might Require a Larger Fund (6+ Months)

- Variable or Commission-Based Income: If your income fluctuates significantly month to month

- Self-Employment: Freelancers and business owners face more income uncertainty

- Single-Income Household: With only one earner, job loss has a bigger impact

- Specialized Career: Jobs that might take longer to replace if lost

- Chronic Health Conditions: May lead to more frequent medical expenses

- Caring for Dependents: Children or elderly parents create additional financial responsibilities

Factors That Might Allow a Smaller Fund (3 Months)

- Dual-Income Household: Less vulnerable if one person loses their job

- Stable Industry: Lower risk of unexpected job loss

- Strong Professional Network: Easier to find new employment quickly

- Additional Safety Nets: Such as family support or easily liquidated investments

- Low Fixed Expenses: More flexibility to reduce spending if needed

Calculation Tip

Focus on essential expenses, not your total income. Add up monthly costs for housing, utilities, food, transportation, insurance, minimum debt payments, and other necessities. Multiply by your target number of months (3-6) to determine your emergency fund goal.

Starting Small: The First $1,000

If building a full 3-6 month emergency fund seems overwhelming, start with a mini emergency fund of $1,000. This initial amount can cover many common emergencies and provide a psychological win while you work toward your larger goal.

Where to Keep Your Emergency Fund

The ideal location for emergency savings balances accessibility, safety, and (modest) growth potential.

Best Options for Your Emergency Fund

-

High-Yield Savings Account

These accounts offer higher interest rates than traditional savings accounts while maintaining FDIC insurance protection (up to $250,000 per depositor, per bank). They provide a good balance of safety, liquidity, and some return on your money.

-

Money Market Account

Similar to high-yield savings accounts but sometimes with higher interest rates and limited check-writing privileges. They're still FDIC-insured and provide quick access to your funds.

-

Cash Management Account

Offered by brokerage firms and robo-advisors, these accounts often provide competitive interest rates and may offer additional features like checking capabilities and reimbursement of ATM fees.

Where NOT to Keep Your Emergency Fund

- Stocks or Stock Mutual Funds: Too volatile; market downturns often coincide with economic conditions that might lead to job loss

- Long-term CDs: Early withdrawal penalties can reduce your accessible funds

- Retirement Accounts: Early withdrawals typically incur taxes and penalties

- Physical Cash at Home: Risk of theft, loss, or damage, plus no interest growth

Strategies to Build Your Emergency Fund

Building an emergency fund takes time and discipline. Here are effective strategies to help you reach your goal:

1. Make It Automatic

Set up automatic transfers from your checking account to your emergency fund on payday. Treating your emergency fund contribution as a non-negotiable expense ensures consistency and removes the temptation to skip contributions.

2. Start with Windfalls

Use tax refunds, work bonuses, cash gifts, or stimulus payments to jumpstart your emergency fund. Since this money isn't part of your regular budget, directing it to savings won't affect your day-to-day finances.

3. Cut Expenses Temporarily

Review your spending and identify non-essential expenses you could reduce or eliminate until you reach your emergency fund goal:

- Subscription services you rarely use

- Dining out or takeout meals

- Premium entertainment packages

- Discretionary shopping

Remember, these cuts don't have to be permanent—just until you've built your safety net.

4. Increase Your Income

Consider ways to temporarily boost your income to accelerate your emergency fund growth:

- Side gigs or freelance work

- Selling unused items

- Overtime hours if available

- Part-time seasonal work

5. Use the "Save First, Then Spend" Approach

Instead of trying to save what's left after spending, reverse the order. Determine your savings amount first, transfer it to your emergency fund, then budget with the remaining income.

Psychological Tip

Name your emergency fund account something specific and motivating, like "Financial Freedom Fund" or "Peace of Mind Account." This creates an emotional connection to your goal and makes it less tempting to withdraw for non-emergencies.

6. Use a Savings Challenge

Make saving more engaging with a structured challenge:

- 52-Week Challenge: Save $1 the first week, $2 the second week, and so on, reaching $52 in the final week (totaling $1,378 after one year)

- No-Spend Challenge: Designate a day, weekend, or week where you spend no money on non-essentials and transfer the savings to your emergency fund

- Save Your Change: Round up purchases to the nearest dollar and save the difference (many banking apps offer this feature automatically)

When to Use Your Emergency Fund

A common pitfall is raiding your emergency fund for non-emergencies. Protect your financial safety net by clearly defining what constitutes a true emergency:

Appropriate Uses for Emergency Funds

- Job loss or significant reduction in income

- Unexpected medical or dental expenses

- Essential home repairs (roof damage, broken heating system)

- Critical car repairs

- Emergency travel (family illness or death)

- Emergency pet care

Not Emergencies (Plan for These Separately)

- Predictable expenses (holiday gifts, annual insurance premiums)

- Routine maintenance (oil changes, home maintenance)

- Vacations or entertainment

- Non-essential purchases or upgrades

- Regular bills you know are coming

Rebuilding After Using Your Emergency Fund

If you need to use your emergency fund, that's exactly what it's there for—don't feel guilty! However, make rebuilding it a priority once your financial situation stabilizes:

- Create a Replenishment Plan: Set a specific timeline and amount to rebuild your fund

- Adjust Your Budget Temporarily: Redirect money from non-essential categories until your fund is restored

- Consider Increasing Your Target: If you found your emergency fund insufficient, consider whether you need to increase your goal amount

- Review What Triggered the Emergency: Determine if there are preventive measures you could take to avoid similar situations in the future

Beyond the Basic Emergency Fund

Once you've established your primary emergency fund, consider these advanced strategies:

Tiered Emergency Savings

Consider a two-tiered approach:

- Tier 1 (1-2 months expenses): Highly liquid account for immediate access

- Tier 2 (remaining 2-4 months): Slightly less accessible but potentially higher-yield options like no-penalty CDs or short-term bond funds

Specialized Sinking Funds

Create separate savings funds for predictable but irregular expenses:

- Home maintenance fund (1-3% of home value annually)

- Vehicle maintenance and replacement fund

- Medical deductible fund

- Holiday and gift fund

These targeted funds prevent you from dipping into your true emergency fund for expenses that are foreseeable but not part of your monthly budget.

Emergency Fund Maintenance

Your emergency fund isn't a "set it and forget it" financial tool. Schedule regular maintenance:

Quarterly Reviews

- Reassess your monthly expenses (do you need to increase your target?)

- Check if your emergency fund is still in the best account (are there better interest rates available?)

- Confirm your fund is properly insured (within FDIC limits)

Annual Adjustments

- Update your target amount to account for inflation and lifestyle changes

- Evaluate if your risk factors have changed (new job, health changes, family responsibilities)

- Consider rebalancing between tiers if you're using a tiered approach

Overcoming Common Challenges

Challenge: "I Can't Afford to Save for Emergencies"

Solution: Start with just 1% of your income and gradually increase. Even $10 per week adds up to over $500 in a year. Look for "found money" opportunities like rebates, cashback rewards, or selling unused items.

Challenge: "My Expenses Are Too High to Save"

Solution: Conduct a thorough budget review to identify potential savings. Often, small changes across multiple categories can free up significant savings without drastically changing your lifestyle.

Challenge: "I Keep Dipping Into My Emergency Fund"

Solution: Create a separate "buffer fund" for non-emergency unexpected expenses. Having this intermediate fund helps protect your true emergency savings while acknowledging that life includes many unplanned (but not emergency) expenses.

Challenge: "I'm Prioritizing Debt Repayment"

Solution: While paying off high-interest debt is important, a small emergency fund prevents you from accumulating more debt when surprises occur. Start with a mini emergency fund of $1,000 before aggressively tackling debt.

Conclusion: Financial Security Begins with Preparation

An emergency fund is more than just money in an account—it's financial security, stress reduction, and the foundation of a solid financial plan. In a world of uncertainty, your emergency fund stands as a buffer between you and life's financial surprises, giving you the breathing room to handle challenges without derailing your long-term financial goals.

Remember that building an emergency fund is a journey, not a one-time achievement. Start where you can, remain consistent, and celebrate your progress along the way. Your future self will thank you for the financial resilience you're building today.