Financial planning isn't just for the wealthy or those approaching retirement—it's a critical life skill that everyone should develop. Whether you're just starting your career, planning to buy a home, or simply want to feel more secure about your financial future, this comprehensive guide will walk you through the essential steps of creating a solid financial plan from scratch.

What Is Financial Planning?

Financial planning is the process of taking a comprehensive look at your financial situation and creating a specific plan to reach your short and long-term goals. It involves analyzing your current financial position, identifying your goals, and developing strategies to achieve those goals while navigating potential obstacles.

A good financial plan addresses all aspects of your financial life, including:

- Budgeting and expense management

- Debt management and reduction

- Emergency fund creation

- Insurance and risk management

- Investment and wealth building

- Tax planning

- Retirement planning

- Estate planning

Step 1: Assess Your Current Financial Situation

Before you can plan where you're going, you need to understand where you are. Start by taking a financial inventory:

Calculate Your Net Worth

Your net worth is the difference between what you own (assets) and what you owe (liabilities).

- List all your assets: Cash, bank accounts, investments, real estate, vehicles, valuable personal property

- List all your liabilities: Credit card debt, student loans, car loans, mortgages, personal loans

- Subtract liabilities from assets: This gives you your current net worth

Don't be discouraged if your net worth is negative, especially if you're young or have significant student loans. The goal is to establish a baseline for measuring progress.

Analyze Your Cash Flow

Understanding where your money goes each month is essential for effective planning:

- Track your income: Salary, freelance work, investments, rental income, etc.

- Track your expenses: Fixed expenses (rent, utilities, loan payments) and variable expenses (food, entertainment, shopping)

- Calculate the difference: Are you spending more than you earn, or do you have surplus cash each month?

Tracking Tip

Use a budgeting app or spreadsheet to track your spending for at least 30 days to get an accurate picture of your spending habits. Many people are surprised to discover where their money actually goes.

Review Your Credit Report and Score

Your credit health impacts many aspects of your financial life, from interest rates to housing options:

- Request free copies of your credit reports from the three major bureaus (Equifax, Experian, and TransUnion)

- Check for errors and dispute any inaccuracies

- Identify areas for improvement, such as high credit utilization or late payments

- Monitor your credit score regularly using free services offered by many credit cards or financial websites

Step 2: Define Your Financial Goals

With a clear understanding of your current situation, you can set meaningful financial goals. Effective goals are:

- Specific: "Save $10,000 for a down payment" rather than "Save money for a house"

- Measurable: You can track your progress numerically

- Achievable: Challenging but realistic given your income and circumstances

- Relevant: Aligned with your values and larger life objectives

- Time-bound: Have a target date for achievement

Categorize your goals into three timeframes:

- Short-term: Less than 1 year (building an emergency fund, paying off credit card debt)

- Medium-term: 1-5 years (saving for a down payment, starting a business)

- Long-term: More than 5 years (retirement, funding children's education)

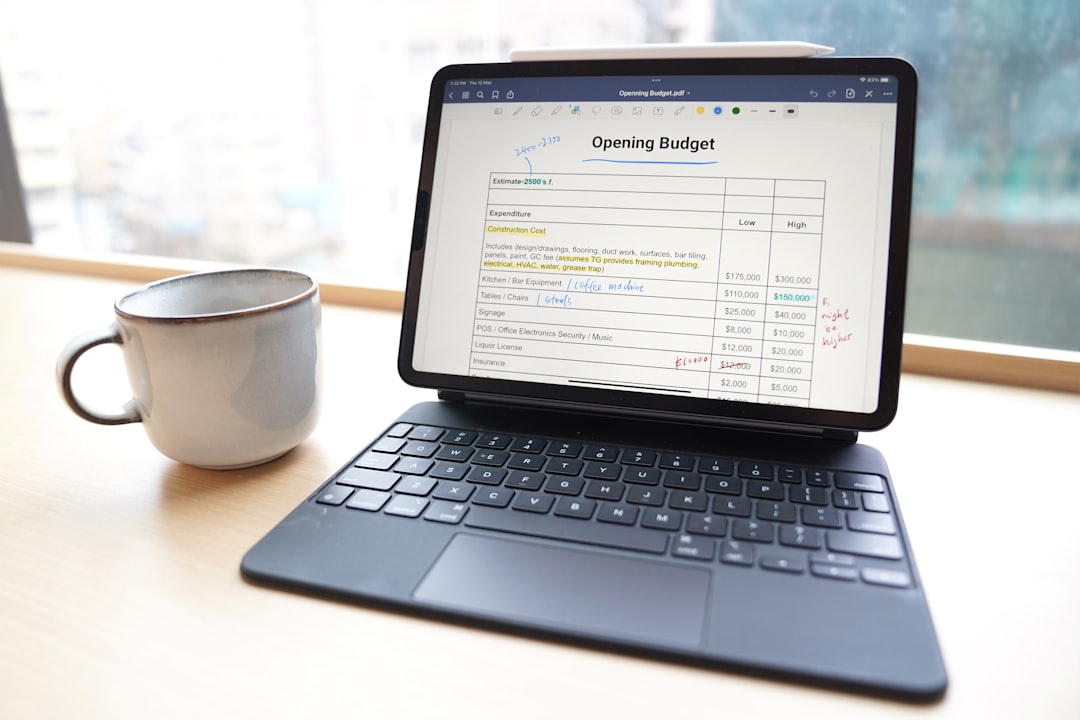

Visualizing your financial goals can help maintain motivation throughout your journey.

Step 3: Create a Budget That Works

Your budget is the foundation of your financial plan. It's not about restriction but about intentional allocation of resources.

Choose a Budgeting Method

Several approaches can work, depending on your personality and preferences:

- 50/30/20 Rule: 50% for needs, 30% for wants, 20% for savings and debt repayment

- Zero-Based Budget: Allocate every dollar of income to a specific purpose

- Envelope System: Divide cash into envelopes for different spending categories

- Pay Yourself First: Automatically direct a portion of income to savings before budgeting the rest

Prioritize Essential Expenses

Ensure your budget covers these crucial elements:

- Housing costs (rent/mortgage, utilities, maintenance)

- Food and groceries

- Transportation (car payment, gas, public transit)

- Healthcare (insurance premiums, medications)

- Minimum debt payments

- Basic personal necessities

Build in Savings

Treat savings as a non-negotiable expense by:

- Setting up automatic transfers to savings accounts

- Taking full advantage of employer retirement matches

- Starting small if necessary (even 1-2% of income) and gradually increasing

Automation Tip

Set up automatic transfers to your savings account on payday. What you don't see in your checking account, you won't be tempted to spend.

Step 4: Build Your Emergency Fund

An emergency fund is your financial buffer against unexpected expenses and income disruptions. This should be one of your first financial priorities.

How Much to Save

Financial experts generally recommend:

- Initial goal: $1,000 for minor emergencies

- Full emergency fund: 3-6 months of essential expenses

- Freelancers/variable income: 6-12 months of expenses

Where to Keep Your Emergency Fund

Your emergency fund should be:

- Liquid: Easily accessible without penalties

- Safe: Not subject to market fluctuations

- Separate: Not mingled with regular checking

Good options include high-yield savings accounts, money market accounts, or cash management accounts.

Step 5: Tackle Debt Strategically

Not all debt is created equal. Develop a plan to eliminate high-cost debt while managing necessary debt responsibly.

Prioritize Debt Repayment

Two popular methods for debt repayment:

- Avalanche Method: Pay off debts with the highest interest rates first (saves the most money)

- Snowball Method: Pay off smallest debts first (provides psychological wins)

Consider Debt Consolidation

If you have multiple high-interest debts, consolidation might help by:

- Combining multiple payments into one

- Potentially lowering your overall interest rate

- Creating a clear payoff timeline

Options include personal loans, balance transfer credit cards, or home equity loans (for homeowners).

Step 6: Ensure Proper Insurance Coverage

Insurance protects your financial plan from catastrophic setbacks. Review and obtain appropriate coverage in these key areas:

Health Insurance

Prioritize health coverage to protect against medical bankruptcies. Consider:

- Employer-sponsored plans

- Marketplace plans under the Affordable Care Act

- High-deductible plans with Health Savings Accounts (HSAs)

Auto and Home/Renters Insurance

Protect your major assets with adequate coverage:

- Auto liability limits should exceed your net worth if possible

- Homeowners insurance should cover full replacement cost

- Renters insurance is inexpensive yet protects your belongings

- Consider bundling policies for discounts

Life Insurance

If others depend on your income, life insurance is essential:

- Term life insurance: Affordable coverage for a specific period (often recommended)

- Permanent life insurance: Lifelong coverage with a cash value component

Coverage amount should typically be 10-12 times your annual income.

Disability Insurance

Your ability to earn income is your most valuable financial asset:

- Check if your employer offers coverage

- Consider supplemental coverage if employer benefits are limited

- Aim for coverage that replaces 60-70% of your income

Step 7: Start Investing for the Future

Once you've established your emergency fund and managed high-interest debt, it's time to focus on building wealth through investing.

Retirement Accounts

Take advantage of tax-advantaged retirement accounts:

- Employer-sponsored plans (401(k), 403(b)): Contribute at least enough to get the full employer match

- Individual Retirement Accounts (IRAs): Traditional (tax-deductible contributions) or Roth (tax-free withdrawals in retirement)

- Solo 401(k) or SEP IRA: For self-employed individuals

Investment Basics for Beginners

Start with these fundamental principles:

- Diversification: Spread investments across different asset classes to reduce risk

- Asset Allocation: Balance between stocks, bonds, and other investments based on your risk tolerance and time horizon

- Index Funds: Low-cost funds that track market indexes are excellent starting points for new investors

- Dollar-Cost Averaging: Invest regularly regardless of market conditions to reduce timing risk

Investment Tip

If you're unsure where to start, consider target-date funds that automatically adjust your asset allocation as you approach retirement.

Step 8: Plan for Major Life Expenses

Beyond day-to-day expenses and retirement, your financial plan should account for significant life milestones.

Home Purchase

Prepare financially by:

- Saving for a down payment (ideally 20% to avoid PMI)

- Improving your credit score to qualify for better interest rates

- Calculating affordability based on a mortgage payment not exceeding 28% of gross income

- Budgeting for closing costs, moving expenses, and home maintenance

Education Funding

If you're planning to help fund education for children:

- Consider tax-advantaged 529 plans

- Start early to benefit from compound growth

- Balance education savings with your retirement needs

Major Life Events

Create specific savings funds for:

- Weddings

- Starting a family

- Career changes or continuing education

- Starting a business

Step 9: Develop an Estate Plan

Even if you're young or don't have substantial assets, basic estate planning ensures your wishes are followed and simplifies matters for your loved ones.

Essential Estate Planning Documents

- Will: Specifies how your assets should be distributed and can name guardians for minor children

- Power of Attorney: Designates someone to make financial decisions if you're incapacitated

- Healthcare Directive: Outlines your medical care preferences if you cannot communicate

- Beneficiary Designations: Review and update beneficiaries on insurance policies and retirement accounts

Step 10: Regularly Review and Adjust Your Plan

Financial planning is not a one-time event but an ongoing process. Schedule regular reviews to ensure your plan remains aligned with your changing life circumstances and goals.

When to Review Your Financial Plan

- Annually, as a general practice

- After major life events (marriage, divorce, birth of a child)

- When experiencing significant income changes

- During major market or economic shifts

- As you approach key milestones like retirement

Common Financial Planning Mistakes to Avoid

- Delaying saving for retirement: Time is your most powerful wealth-building tool

- Inadequate emergency fund: Leaving yourself vulnerable to financial setbacks

- Overlooking insurance: Proper coverage protects your financial foundation

- Lifestyle inflation: Automatically increasing spending as income rises

- Failing to diversify investments: Putting too many financial eggs in one basket

- Emotional financial decisions: Making choices based on fear or exuberance rather than your plan

When to Seek Professional Help

While many aspects of financial planning can be self-managed, consider working with a professional financial planner in these situations:

- Your financial situation is complex (business ownership, substantial assets)

- You're facing major life transitions (inheritance, retirement, divorce)

- You lack the time or interest to manage your finances personally

- You need specialized advice on tax strategies or estate planning

- You struggle with financial discipline and would benefit from accountability

When seeking a financial planner, look for credentials like CFP® (Certified Financial Planner) and understand how they're compensated (fee-only, commission, or fee-based).

Conclusion: Your Financial Journey Starts Now

Financial planning might seem overwhelming at first, but remember that it's a journey, not a destination. You don't need to implement everything at once. Start with understanding your current situation, creating a budget, building an emergency fund, and addressing high-interest debt. Then gradually work through the remaining steps.

The most important thing is to begin. Even small steps taken consistently will compound over time, creating financial stability and eventually wealth. Your future self will thank you for the financial foundation you're building today.